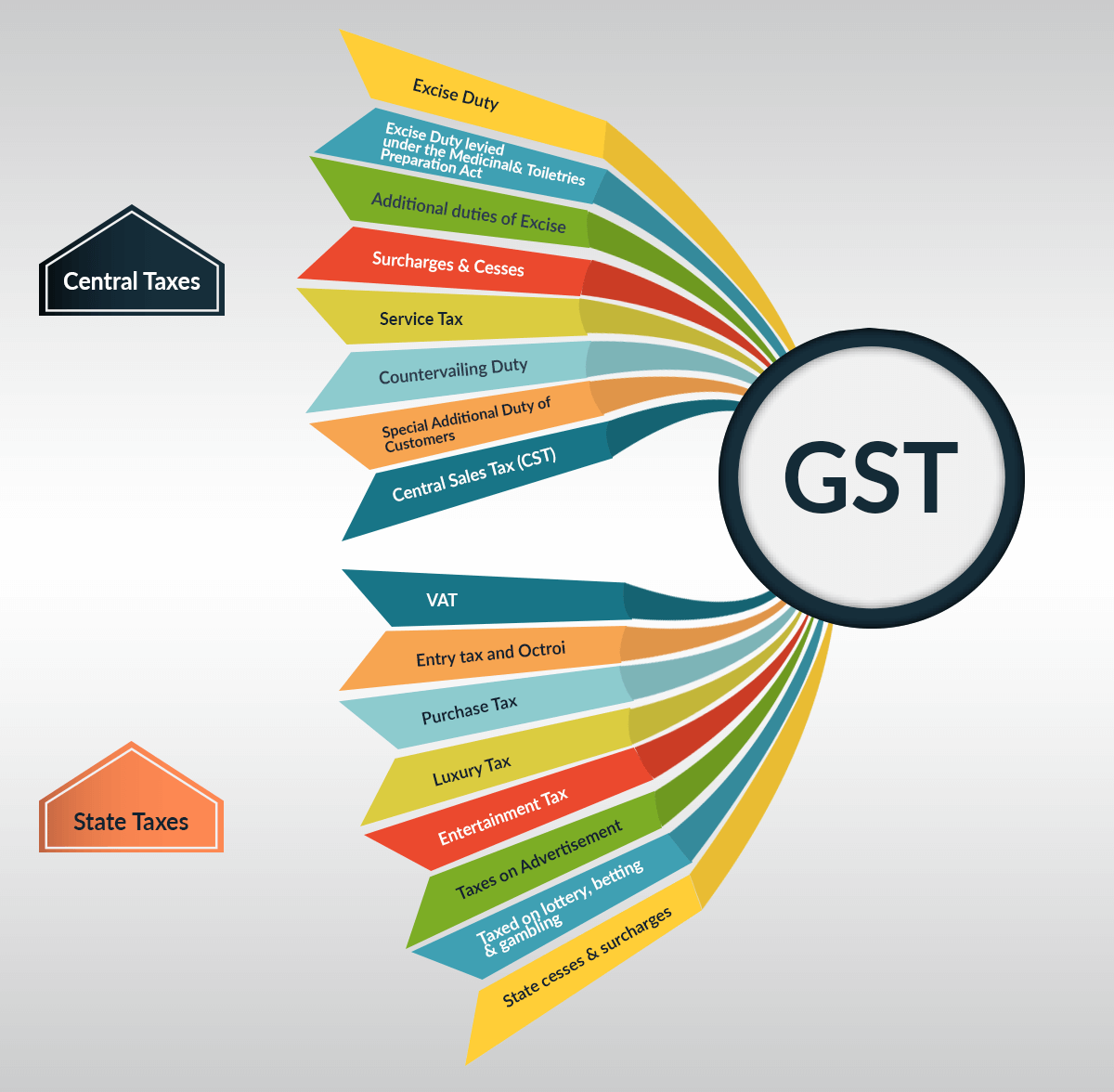

Service and goods is the government the tax system that is suggested by the government. GST is executed these taxes will be replaced with one taxes that is called as Goods and Service Tax. If you would like your company to register with the GST act in Delhi, then you need to approach Tax Home.

Elimination of Multiple Taxes: The largest benefit of gst filing singapore is the elimination of numerous indirect taxes. Will not be in a picture. This implies and all that will fall under common.

Elimination of Multiple Taxes: The largest benefit of gst filing singapore is the elimination of numerous indirect taxes. Will not be in a picture. This implies and all that will fall under common.- Saving More Money: This will reduce the purchase price of products and services and for saving money, help man.

- Easy Tax Filing and Documentation: For a businessman, GST will be a boon. No taxes means documentation and compliance will be simple. Return filing, hassle-free and tax payment, and refund procedure will simple.

- Reduction in Tax Evasion: it is a single tax that will include various taxes, which makes the system efficiency with hardly any odds of corruption and Evasion.

- Increase in Earnings: It will replace all 17 indirect taxation with the tax. Tax revenue wills increase for authorities and state.

GST Removes the cascading effect of taxes

Higher threshold for enrollment, Composition strategy for small companies, Simple and easy online procedure, the Amount of compliances is lesser, Defined remedy for E-commerce operators, Improved efficiency of logistics, Unorganized sector is controlled under GST. They will provide you the wager GST rates in Delhi. So strategy Tax Home and enjoy several benefits under the GST. They offer services such as business registration, GST Registration, individual loan and worldwide taxation in Delhi at an affordable and efficient cost. Theyprovide SSI Online Registration in Delhi to your company at the best price.